Fragmetric (FRAG): Building a Modular DeFi Asset Standard on Solana

What is Fragmetric?

(Source: fragmetric)

As the Solana ecosystem rapidly expands, Fragmetric has quickly positioned itself as a leader in liquid restaking protocols, thanks to its innovative FRAG-22 standard and decentralized asset management solutions. Initially launched as a native liquid staking protocol for Solana, Fragmetric has evolved into a comprehensive smart platform offering multi-asset support, modular yield aggregation, and real-time reward distribution. The project aims to deliver efficient and transparent asset management infrastructure to every user.

FRAG-22: The Next-Generation Asset Standard for Solana

FRAG-22 is Fragmetric’s proprietary asset standard for Solana, built upon the Solana Token 2022 framework and leveraging transfer hook technology to enable:

- Simultaneous multi-asset deposits with standardized processing

- Accurate, real-time multi-reward distribution

- Modular strategy integration, including liquidity pools, lending protocols, yield farms, and structured DeFi products

This approach not only solves the challenges of asset fragmentation and reward tracking common in traditional staking protocols but also creates a strong foundation for composability in the Solana ecosystem—dramatically boosting the efficiency of adoption and integration for users and developers alike.

SANG: Co-Guardians of the Community and Protocol

Being a SANG (SolanA Network Guard) means more than just being a user—it signifies being a protector of both protocol security and the Solana ecosystem itself. By participating in liquid restaking through Fragmetric, you join forces with community members and founder Sang to drive governance, develop innovative solutions, and enable the rollout of new AVS modules and other cutting-edge features. This collaborative, decentralized approach to governance has been crucial to Fragmetric’s emergence as a standout in the Solana landscape.

Core Product Features

- Highly efficient reward tracking and distribution: Every transaction automatically triggers instant calculations and real-time reward updates, ensuring fairness for all participants

- Modular yield strategy integration: Seamlessly connect with a wide range of DeFi strategies to maximize returns

- Multi-asset aggregation: The FRAG-22 standard alone can represent a diverse set of assets, boosting liquidity efficiency and streamlining trading

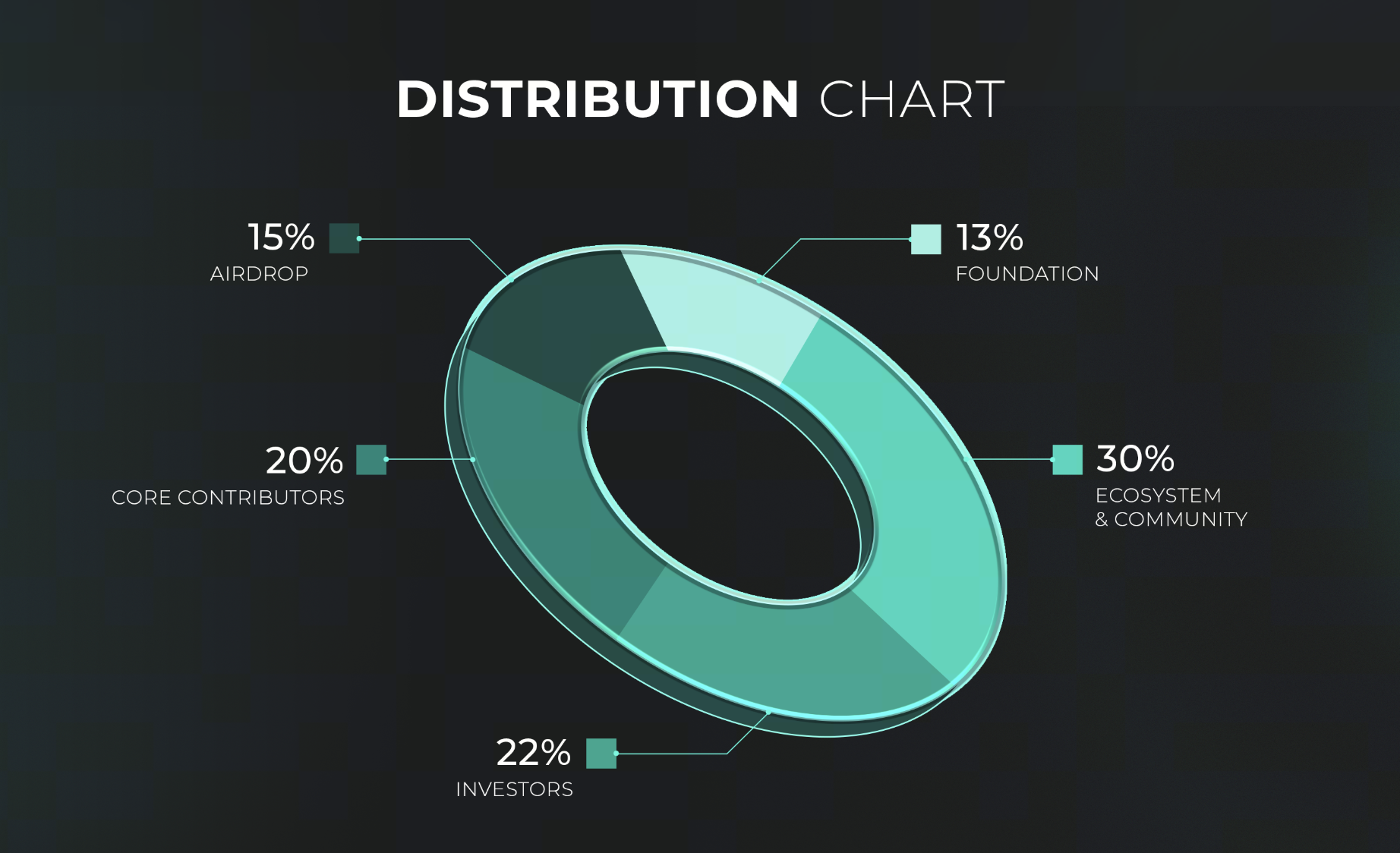

FRAG Tokenomics

FRAG is the native governance and utility token of the Fragmetric protocol, with a total supply of 1 billion tokens and an initial circulating supply of 202 million. Its tokenomics are designed to balance sustainable growth with strong long-term community incentives. The allocation is as follows:

- Core Contributors (20%): Allocated to the Fragmetric Labs team and advisors, with a one-year cliff followed by two years of linear monthly vesting.

- Investors (22%): Includes early backers and Legion community sale participants. 10% unlock at Token Generation Event (TGE); the remainder subject to a one-year cliff, then vesting linearly over two years.

- Foundation (13%): Intended for protocol development, risk assessment, audits, and other foundation expenses. Vested quarterly over four years.

- Ecosystem & Community Development (30%): Supports R&D, developer incentives, and user growth. One-third unlocked at launch (with 20% dedicated to airdrops); the rest vests quarterly over four years.

- Airdrop (15%): 8% allocated to first-season airdrop; remaining 7% reserved for future campaigns, distributed based on user contribution and engagement levels.

(Source: docs.fragmetric)

FRAG Use Cases

- Governance & Participation: Stake FRAG to convert into FRAG², obtain FVT, and engage in protocol governance and strategic planning

- Yield Enhancement: Participate in staking, airdrops, and the FRAG² rewards mechanism

- Liquidity Integration: FRAG-22 can be integrated with DeFi ecosystems, including liquidity pools, lending platforms, and yield farms

FRAG²: Unlocking Governance and Rewards

FRAG² is the staked form of FRAG. By locking your FRAG tokens in Fragmetric Station, you’ll receive FRAG² and FVT (governance voting tokens), enabling you to:

- Vote on governance proposals: Submit ideas, cast votes, and actively shape the protocol’s future direction

- Access reward mechanisms: Earn FRAG² APY rates and bonus points, both of which scale with the duration and degree of your participation

- Participate in grants programs: FRAG² holders determine funding allocation decisions for ecosystem proposals

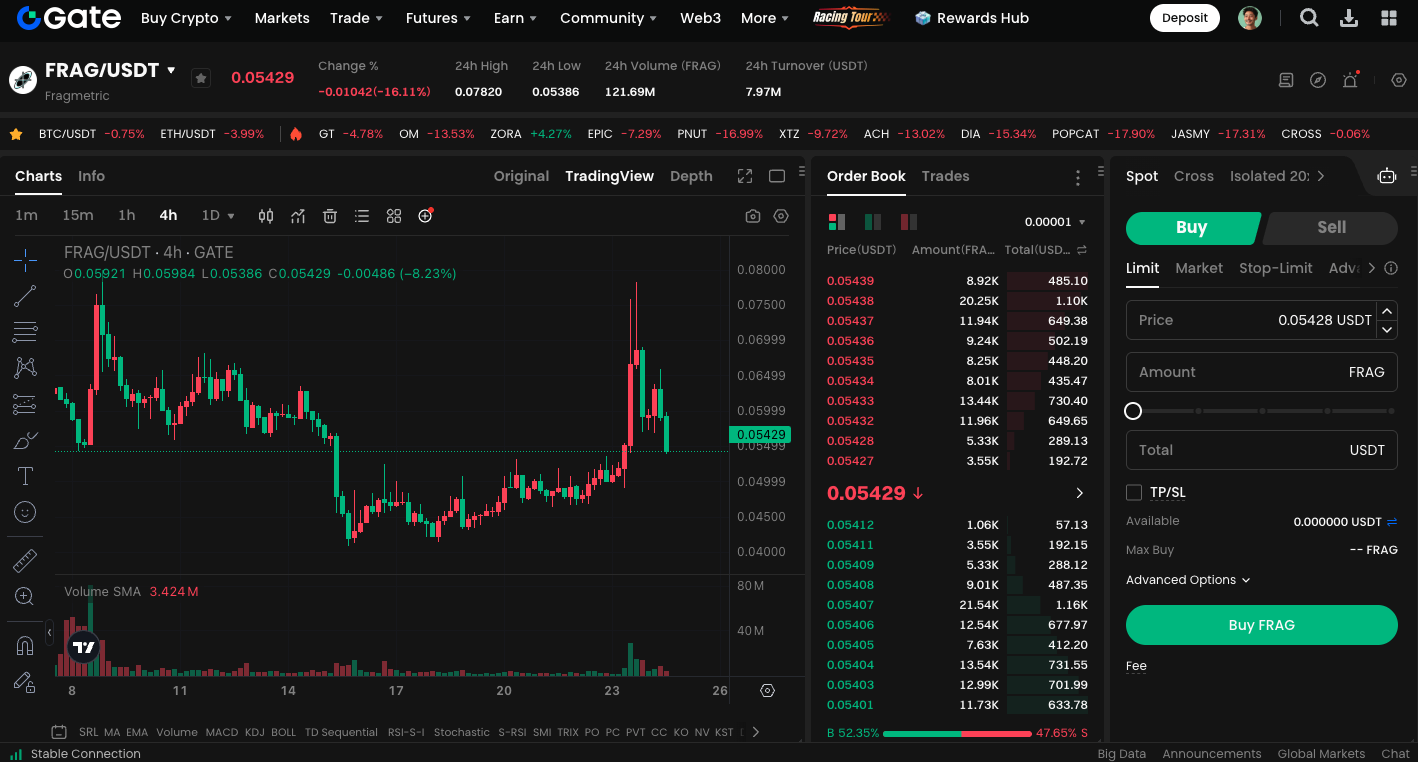

Start trading FRAG spot today: https://www.gate.com/trade/FRAG_USDT

Future Outlook and Summary

Fragmetric’s vision goes beyond a simple staking protocol; it is focused on building an open, modular, and secure foundational layer for asset management. The FRAG-22 standard will continue to expand its use cases and integrate with a growing number of Solana application-layer protocols, driving further upgrades across the broader financial infrastructure.