Treehouse Protocol Deep Dive: Ushering in a New Era of Rate Oracles and Decentralized Fixed Income

What is TreeHouse?

Image: https://www.treehouse.finance/

TreeHouse is a decentralized interest rate oracle protocol built on Ethereum, designed to deliver transparent and trustworthy interest rate benchmarks for the blockchain ecosystem through its DOR (Decentralized Offered Rate) mechanism. At its core, TreeHouse achieves decentralized data consensus by empowering community participants to collaboratively submit and forecast on-chain rates.

DOR Model Overview: Pioneering Decentralized Interest Rate Pricing

The DOR mechanism is central to TreeHouse, leveraging consensus rules and incentive structures to drive professional panelists to report credible rate data. Currently, TreeHouse is rolling out its first DOR product—TESR (Treehouse Ethereum Staking Rate) Curve. This establishes a pricing benchmark for Ethereum’s liquid staking market.

The DOR ecosystem features several key roles:

- Panelists: Submit rate data or forecasts and must stake TREE or tAssets;

- Operators: Launch DOR sessions and ensure data accuracy—TreeHouse serves as the inaugural Operator;

- Delegators: Delegate tAssets to Panelists;

- Referencers: Protocols or products that integrate DOR data.

Core Use Cases of the TREE Token

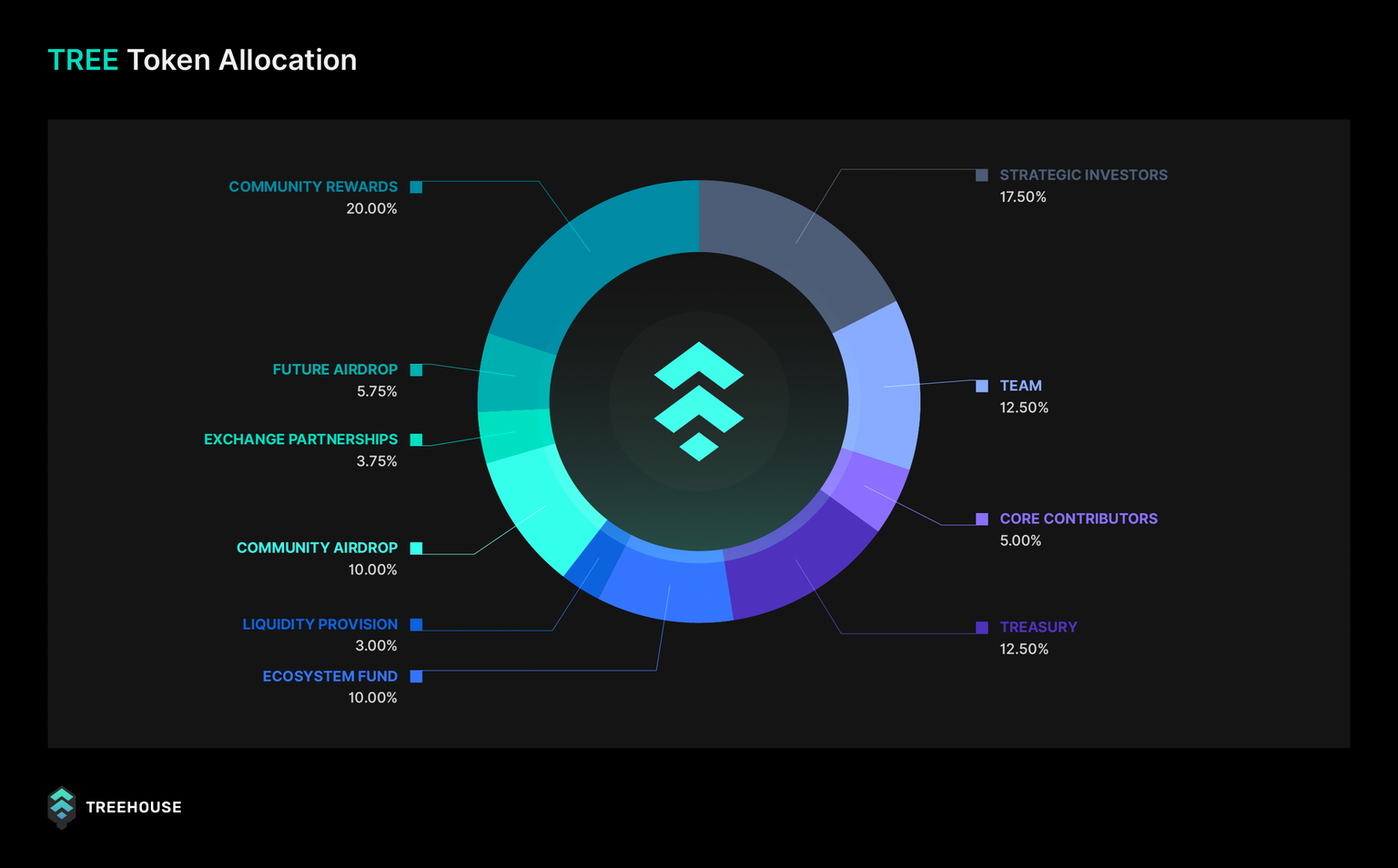

Image: https://docs.treehouse.finance/protocol/tree-token/token-details/tokenomics

TREE is the native utility token of the TreeHouse protocol, serving the following critical functions:

- Query Fees: Referencers pay TREE when accessing DOR data;

- Panelist Staking: Panelists must hold and stake TREE;

- Consensus Rewards: Distributed according to forecast accuracy;

- Governance: TREE holders vote on protocol parameters;

- Ecosystem Incentives: TREE is allocated by the DAO to support ecosystem developers and projects.

How to Participate and Ecosystem Roles

TreeHouse provides the following participation options:

- GoNuts event: Users can earn Nuts by staking or engaging in specific activities. Nuts serve as credentials required for airdrop eligibility;

- Airdrop Mechanism: Users must hold at least 100 Nuts and pass Sybil resistance verification to receive TREE;

- TSC NFT Program: TSC NFT holders are eligible to claim an additional 500 TREE tokens;

- Vested and Non-Vested Distribution: Token distribution and unlock schedules are determined by each user’s contribution level.

TreeHouse: Long-Term Potential Assessment

TreeHouse is more than just an interest rate oracle; it plays a key role in developing on-chain financial benchmarks. In the future, TreeHouse could serve as the standard interest rate reference for LSD protocols, on-chain fixed-rate bonds, and DeFi insurance. As the DOR mechanism matures, TreeHouse can become a foundational benchmark for blockchain-based finance.

Gate will launch spot trading for Treehouse (TREE) on July 29, 2025, at 22:00 (UTC+8).