Post content & earn content mining yield

placeholder

SequoiaBlockchain

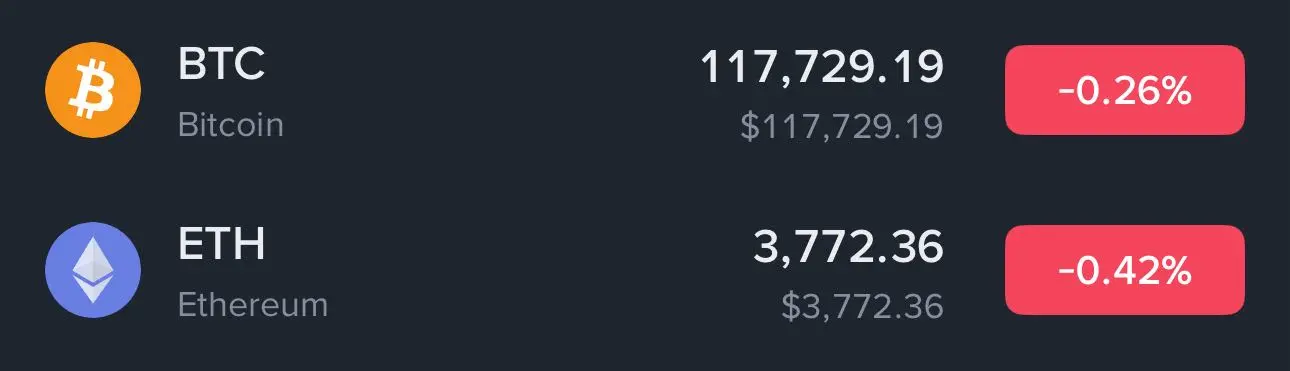

The "old Whale" who has been silent for 14 years and holds nearly 4000 Bitcoins recently transferred 30 coins to the exchange, which is indeed a bit concerning. However, to be honest, there is no need to panic too much about this.

For ordinary investors, instead of fixating on this single event, it's better to look at the overall trend: long-term holders still make up the majority, and institutions are continuously entering the market, which is actually quite stable. If you're really worried, pay more attention to his subsequent on-chain movements, and just don't let short-term emotions mislea

For ordinary investors, instead of fixating on this single event, it's better to look at the overall trend: long-term holders still make up the majority, and institutions are continuously entering the market, which is actually quite stable. If you're really worried, pay more attention to his subsequent on-chain movements, and just don't let short-term emotions mislea

BTC-0.21%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- 9

- 5

- Share

Seta13455126 :

:

Top Overnight News The dollar gained after Donald Trump downplayed his clash with Jerome Powell over the Fed's renovation costs, saying it wasn't reason enough to fire him. Trump said during his visit to the Federal Reserve that it is a tough construction job

View More

DOGE started trading at $0.240, rose to $0.248, and then fell sharply to $0.223 during the active trading hours in the U.S. A bounce back overnight brought the price back to $0.226, indicating that buy orders are accumulating near the Accumulation zone. Notably, the volume during the dumping surged to 918 million, more than double the average level over 24 hours. This suggests that large investors may have triggered stop loss orders, which could provide a foundation for recovery if demand returns. Over the past 7 days, the charts look even gloomier, with a decline of over -18%.

DOGE-0.83%

- Reward

- like

- Comment

- Share

In the field of cryptocurrency trading, there are often doubts about whether small amounts of capital still have opportunities. However, the reality is quite the opposite; it is often those traders who are adept at utilizing limited funds that achieve significant growth in this market.

For traders who are new to the market, even starting with just a few hundred dollars should not be discouraging. The key lies in how to effectively utilize these funds, rather than engaging in high-risk full-position trades or frequent impulsive transactions. Such reckless behavior often leads to rapid depletion

View OriginalFor traders who are new to the market, even starting with just a few hundred dollars should not be discouraging. The key lies in how to effectively utilize these funds, rather than engaging in high-risk full-position trades or frequent impulsive transactions. Such reckless behavior often leads to rapid depletion

- Reward

- 9

- 5

- Share

GateUser-c802f0e8 :

:

Let's put it this way: only a coward would take a full position.View More

#IKA# pump it up and directly short. Low leverage is for shorting. The pump is so strong. Altcoins only deserve to be shorted. Copy the free Bots below, it's a sure way to make money, no problem. #BTC# #ETH# #DOGE# please follow me. Thank you! (Suggested leverage below 5x.)

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Share

As long as it breaks the support point of 0.085, this coin of A3 is completely finished, indicating that this coin of A3 is doomed. Brothers, cut loss and withdraw! There is no hope, this coin will definitely be delisting.

View Original- Reward

- like

- 3

- Share

GateUser-893e1a3a :

:

I'm in trouble.View More

- Reward

- 1

- Comment

- Share

The Unholy Trinity △ Law for men: handsome, wealthy, devoted.

The Unholy Trinity of Women △ Law: Gentle, Smart, Beautiful.

The Unholy Trinity △ theorem of a girlfriend: big breasts, long legs, beautiful.

The project's Unholy Trinity △ law: layout, strength, community.

View OriginalThe Unholy Trinity of Women △ Law: Gentle, Smart, Beautiful.

The Unholy Trinity △ theorem of a girlfriend: big breasts, long legs, beautiful.

The project's Unholy Trinity △ law: layout, strength, community.

- Reward

- like

- Comment

- Share

A Beginner's Guide for Newbies in the Crypto World: Avoiding 90% Eyewash

If you are a newbie who has just entered the crypto world, with no one to guide you and relying solely on your own exploration, you are likely to fall into pitfalls – even losing everything. This is not an exaggeration: too many people enter and are targeted by Ponzi schemes and pig-butchering scams, only to realize they have become "chives" when the project collapses and the tokens become worthless.

But there is really no need to deny everything because of this: blockchain is just a technology, and it has nothing to do w

View OriginalIf you are a newbie who has just entered the crypto world, with no one to guide you and relying solely on your own exploration, you are likely to fall into pitfalls – even losing everything. This is not an exaggeration: too many people enter and are targeted by Ponzi schemes and pig-butchering scams, only to realize they have become "chives" when the project collapses and the tokens become worthless.

But there is really no need to deny everything because of this: blockchain is just a technology, and it has nothing to do w

- Reward

- like

- Comment

- Share

- Reward

- 8

- 6

- Share

Leek_sDoctor :

:

Right now, smash 800,000 ethView More

- Reward

- 13

- 8

- Share

AMIRA123 :

:

DYOR 🤓View More

Grok predicts that $BTC will reach $25 million in 2046 (in 21 years).

wtf?

If that's really the case, it would be a perfect retirement plan😎😎

Three valuation methods:

1. Compound Annual Growth Rate (CAGR)

Assuming Bitcoin continues to grow at an average CAGR of 30%, gradually decreasing to 20% (i.e., growth becomes conservative)

The valuation is approximately $13m each.

This article is sponsored by #Gate Exchange | @Gate_zh

2. Stock-to-Flow (Inventory to Output Ratio Model)

The supply of Bitcoin is halved every four years, with a final total of 21 million coins.

The model predicts a future t

View Originalwtf?

If that's really the case, it would be a perfect retirement plan😎😎

Three valuation methods:

1. Compound Annual Growth Rate (CAGR)

Assuming Bitcoin continues to grow at an average CAGR of 30%, gradually decreasing to 20% (i.e., growth becomes conservative)

The valuation is approximately $13m each.

This article is sponsored by #Gate Exchange | @Gate_zh

2. Stock-to-Flow (Inventory to Output Ratio Model)

The supply of Bitcoin is halved every four years, with a final total of 21 million coins.

The model predicts a future t

- Reward

- 2

- 4

- Share

AMIRA123 :

:

1000x Vibes 🤑View More

Night Highlights on July 29

Pay close attention to the resistance level of 118700 for Bitcoin during the night. If the four-hour closing price cannot stay above this level, it indicates that the rebound lacks strength, and we need to look down at the support level of 117500. If this level breaks, we will have to look for support between 116000 and 115000. However, if the four-hour chart can close back above 118700, then those holding short positions should exit first, as the market is likely to start consolidating. The resistance above is at 119800-120300, but unless the level of 121000 is bro

View OriginalPay close attention to the resistance level of 118700 for Bitcoin during the night. If the four-hour closing price cannot stay above this level, it indicates that the rebound lacks strength, and we need to look down at the support level of 117500. If this level breaks, we will have to look for support between 116000 and 115000. However, if the four-hour chart can close back above 118700, then those holding short positions should exit first, as the market is likely to start consolidating. The resistance above is at 119800-120300, but unless the level of 121000 is bro

- Reward

- like

- Comment

- Share

- Reward

- 1

- 1

- Share

LinBeiL :

:

Understand, brother, the control the market trend is too strong.Load More

- Topic1/3

12k Popularity

61k Popularity

14k Popularity

20k Popularity

2k Popularity

- Pin

- #Gate 2025 Semi-Year Community Gala# voting is in progress! 🔥

Gate Square TOP 40 Creator Leaderboard is out

🙌 Vote to support your favorite creators: www.gate.com/activities/community-vote

Earn Votes by completing daily [Square] tasks. 30 delivered Votes = 1 lucky draw chance!

🎁 Win prizes like iPhone 16 Pro Max, Golden Bull Sculpture, Futures Voucher, and hot tokens.

The more you support, the higher your chances!

Vote to support creators now and win big!

https://www.gate.com/announcements/article/45974

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

1️⃣ #ETH Hits 4800# | Market Analysis & Prediction: Boldly share your ETH predictions to showcase your insights! 10 lucky users will split a 0.1 ETH prize!

Details 👉 https://www.gate.com/post/status/12322612

2️⃣ #Creator Campaign Phase 2# |ZKWASM Topic: Share original content about ZKWASM or its trading activity on X or Gate Square to win a share of 4,000 ZKWASM!

Details 👉 https://www.gate.com/post/st