- Topic

2k Popularity

4k Popularity

915 Popularity

30k Popularity

31k Popularity

54k Popularity

18k Popularity

29k Popularity

143k Popularity

1850k Popularity

- Pin

- 🎊 ETH Deposit & Trading Carnival Kicks Off!

Join the Trading Volume & Net Deposit Leaderboards to win from a 20 ETH prize pool

🚀 Climb the ranks and claim your ETH reward: https://www.gate.com/campaigns/site/200

💥 Tiered Prize Pool – Higher total volume unlocks bigger rewards

Learn more: https://www.gate.com/announcements/article/46166

- 📢 ETH Heading for $4800? Have Your Say! Show Off on Gate Square & Win 0.1 ETH!

The next bull market prophet could be you! Want your insights to hit the Square trending list and earn ETH rewards? Now’s your chance!

💰 0.1 ETH to be shared between 5 top Square posts + 5 top X (Twitter) posts by views!

🎮 How to Join – Zero Barriers, ETH Up for Grabs!

1.Join the Hot Topic Debate!

Post in Gate Square or under ETH chart with #ETH Hits 4800# and #ETH# . Share your thoughts on:

Can ETH break $4800?

Why are you bullish on ETH?

What's your ETH holding strategy?

Will ETH lead the next bull run?

Or any o

- 🧠 #GateGiveaway# - Crypto Math Challenge!

💰 $10 Futures Voucher * 4 winners

To join:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Drop your answer in the comments

📅 Ends at 4:00 AM July 22 (UTC)

- 🎉 [Gate 30 Million Milestone] Share Your Gate Moment & Win Exclusive Gifts!

Gate has surpassed 30M users worldwide — not just a number, but a journey we've built together.

Remember the thrill of opening your first account, or the Gate merch that’s been part of your daily life?

📸 Join the #MyGateMoment# campaign!

Share your story on Gate Square, and embrace the next 30 million together!

✅ How to Participate:

1️⃣ Post a photo or video with Gate elements

2️⃣ Add #MyGateMoment# and share your story, wishes, or thoughts

3️⃣ Share your post on Twitter (X) — top 10 views will get extra rewards!

👉

Public offerings also use AI to speculate in stocks?

Source: Yuanchuan Investment Review (ID: caituandzd), author | Zhang Weidong, editor | Zhang Jieyu

After changing the landscape of the private equity industry, quantification is penetrating into the public equity product ecosystem.

In the second quarter of this year, the scale of Huaxia Sun Meng, China Merchants Wang Ping and Western Lide Shengfengyan exceeded 10 billion. In addition, the scale of Guojin Ma Fang and Wanjia Qiao Liang, who are already tens of billions of quantitative fund managers, has also soared. The public offering quantitative circle has gradually moved from small to transparent, and the way to attract people's attention has also deviated from the past narrative of "small tracking error", showing their respective abilities to make excess in the snail shell.

A quantitative fund manager who did not want to be named told the author that the people who have done well in quantitative public offering performance this year have basically stepped on two outlets, one is microcaps and the other is AI. **

It’s easy to explain how to do micro-caps, that is, spread the pie in companies with a market value of less than 2.5 billion to make an excess, and sell them when the market value becomes larger. Compared with this method of rubbing small tickets, AI quantification is not so easy to understand.

Not only the strategy itself, but even the quantitative public offering road show is like a black box. Once someone asks how AI strategies are applied, fund managers like to use machine learning black boxes to avoid problems. I basically can’t ask any more questions.

In the context of "compliance is paramount", out of consideration of preventing peers from learning, even some failure factors are not willing to be disclosed. This makes some newcomers to the industry feel powerless to investigate quantitative fund managers. So much so that the entire industry and even the fund managers themselves can only evaluate the level of a quantitative fund manager based on its historical performance.

When everyone's money is pouring in, but they can't understand it, a crucial problem is in front of them. Is the quantitative use of AI in public offerings an effective tool or a marketing gimmick?

01 Open the black box

People often idolize things they don't understand. Especially for products of this type of public offering quantification, some fund managers generously shared with the author. When talking about AI strategies during the ** roadshow, customers showed a half-knowledgeable expression, which is the best state. **

In fact, what public AI does is not something that cannot be explained in plain language. **Western Lide Shengfengyan once told the author that the use of AI in public equity stock selection is mainly reflected in three aspects: text analysis, multi-factor stock selection and high-frequency volume and price data mining. **

Text Analysis is the easiest to understand. It usually refers to fund managers’ various AI models based on the Transformer architecture, which can semantically understand the context of text data such as research reports and news broadcasts, and analyze the emotional information contained in different texts, thereby assisting decision-making.

Transformer is the most popular deep learning model in recent years, and its performance on text tasks such as machine translation exceeds that of traditional deep learning models such as RNN and CNN. ChatGPT, which exploded this year, is also based on Transformer.

For example, last year, the seller was able to produce more than 200 reports per day, and the number of words in the abstract alone exceeded 270,000 words. Traditional quantification can understand standardized financial figures, but it cannot understand that Starbucks' medium cup is actually a small cup, and the neutrality written by analysts in research reports is actually bearish. **

To make a good investment in China, an understanding of news policy is an inevitable part. A quantitative fund manager who did not want to be named described this to the author, "Online communication can understand the deep meaning of the news broadcast at least at the deputy director level. Our AI model can only be regarded as a hobby in interpreting news. I will strive to have the comprehension ability of the deputy department next year.”

The second application scenario of AI is multi-factor stock selection. The traditional quantitative multi-factor framework uses the characteristics of historical bull stocks to find the appearance of potential bull stocks in the future, such as those with low valuations, good performance, increased holdings by management, Stocks that no one pays attention to.

As a comparison, the application of AI in this scenario is mainly reflected in nonlinear factor superposition. For example, public funds still feed the models with factors with economic meaning and logic, but in the selection of models, they will use tree structures and neural networks to participate in investment.

If restrictions are relaxed, AI can discover more factors that humans may never understand.

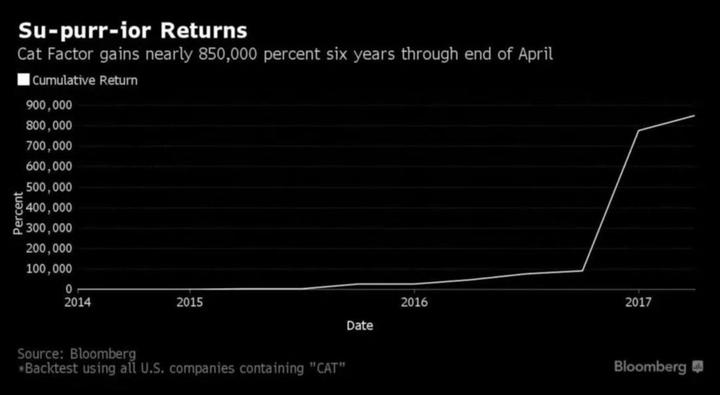

In 2017, Dani Burger, a famous reporter from Bloomberg, conducted an experiment. Because she likes cats, she created a company combination with the three letters "CAT" in its name. **Results: Backtested over the past six years, the return rate was as high as 850,000%. **

** **Such a "cat factor" seems ridiculous to Andrew Unger, head of factor investment strategy at BlackRock: "I prefer dogs. I believe that a company that regards Labrador as its spiritual representative will definitely be able to do well." Good." The results also ran down, the dog combination fell by 99.6% [2] 。

**Such a "cat factor" seems ridiculous to Andrew Unger, head of factor investment strategy at BlackRock: "I prefer dogs. I believe that a company that regards Labrador as its spiritual representative will definitely be able to do well." Good." The results also ran down, the dog combination fell by 99.6% [2] 。

**In the field of investment, the learning path of human nature and AI is different. Humans may extract laws through economic principles or common sense; while AI learns a useful function through a large amount of data, and this function may be wrong , unreasonable, but has good accuracy in input and output results. **

Precisely because AI is highly efficient at analyzing and processing data that humans cannot match, its last application scenario is in high-frequency volume and price data mining.

In 2022, there will be nearly 5,000 A-share stocks, and the high-frequency quantitative data generated will be about 12T, which contains the behavioral regular characteristics of all A-share participants. Since 2017, due to the unprecedented involution of subjective fund managers, the effectiveness of A-share stock prices at the monthly level has reached a new height, but the high-frequency level is still at a low level.

This means that to a certain extent, AI can predict the future based on mathematical statistics. Sheng Fengyan shared with the author that he is using the cyclic neural network RNN as the basis to transform it, because such a model is very suitable for dealing with the timing characteristics of volume and price, and the effect is like adding radar to a laser cannon.

There is no doubt that the terrifying learning ability presented by AI has quietly changed the pattern of the entire industry. Xu Wenxing of China Europe Fund once told the author: "Some fund managers are very diligent and listen to many expert meetings every day, but have you ever thought that a large model can listen to 5,000 conference calls every day? It only needs to summarize a large number of patterns to achieve 52% The probability of beating the market is enough.」

02 Entropy increase is on

Fund companies have always liked things with style. From Nanfang's AI promotional video, Xingquan's AI trader, to Jin Zicai's digital clone, it is rumored that 100 roadshows can be performed in one day. Times have changed, and the main marketing line of fund companies has shifted from outdoor sports to cyber future.

And public fundraising quantification, which seems to be closest to cutting-edge technology, will naturally not miss the Beta of this era. In the previous survey, Bodao Yang Meng told the author: "The entire domestic quantitative market has gradually entered the era of AI algorithms after 2018, and until 21 and 22 years AI has caused extensive discussions in public offerings."

Such as this year's hottest Quantitative multi-factor Yao Jiahong team, Huaxia Zhisheng Pioneer Sun Meng, Guotai Junan Hu Chonghai and Wanjia Qiao Liang, etc. have clearly stated that they use machine learning in their quantitative investments. For example, Shengfengyan mainly used AI technology in the newly launched Western Profit CSI 1000 in April this year, which clearly outperformed the average of similar products.

**These all prove that AI is the fastest commercialization scenario in China and is reflected in performance levels. It is neither an upgraded version of Microsoft 365 Copilot, a three-piece office suite, nor an online AI painting that looks real, but a quantification of fund companies. stocks. **

Unlike subjective investment, which can tell all kinds of hype stories, some talk about betting on disruptive innovation, some talk about growing crops in saline-alkali land, and some would rather count the moon than the stars. It seems extremely difficult to explain quantitative investment, and the outside world can only describe and analyze the number of cards owned by a certain institution.

However, the emergence of AI has given a new breakthrough to the narrative of the entire industry.

In Sun Meng’s marketing materials, there will be no description of the cooperation between China Xiaxia and Microsoft Research Asia in 2017. In 2018, China Microsoft proposed the attention model to learn to solve the industry rotation problem, and then proposed the Autoencoder model to describe the market status and generate the Machine alpha automation factor. In 2019, these results were used for real trading.

Since Microsoft is an investor in OpenAI, compared with other public offerings, it is easy for Christians to pay for China's AI+, which was earlier launched and whose pedigree seems to be more pure.

As for Guojin Quantitative Multi-Factor, it is one of the few products that can compete with Jinyuan Shun'an Yuanqi in terms of popularity in the past two years. Different from "Yuanqi" human flesh quantification and microcap stocks, they are pure quantification.

Ma Fang also said in an internal communication that her approach is not purely multi-factor, but more about prediction by the model itself and tracking changes in market style. After the framework is completed, she will not have too much manual intervention. Because in her opinion, “artificial intervention will not bring about long-term stable alpha.”

The author mentioned in "Micro-cap stocks are too crowded, too many people have secrets" that Guojin Quantitative multi-factor scale has expanded too fast. Last year, it held 1,534 stocks. If you hold more than 2,000 stocks, you will completely earn small-cap style money up. Not surprisingly, China National Finance Corporation has issued a new fund to Ma Fang while the iron is hot.

In recent years, Guotai Junan Quantitative Stock Selection and Guojin Quantitative Multi-factor have similar excess stability. In Xueqiu, you can see dense articles promoting Hu Chonghai.

His strength lies in his ability to trade. A senior fund researcher told the author that ** Guojun is one of the few public institutions that develops its own trading system. It has evolved from a simple VIP split to now having its own predictive trading algorithm. As a subsidiary of Guotai Junan Securities, it not only has low transaction fees and fast transaction speeds, but also provides the convenience of server hosting. The most secret is that it can obtain many alternative data and high-frequency data needed by AI. **

Compared with the above-mentioned quantitative masters, Qiao Liang of Wanjia is more recognizable. He constructed a "Following Banker Index".

In his exponential growth model, machine learning will be used to divide the market into 8 scenario styles, and then match the corresponding historical scenarios for factor configuration. The most special one is Wanjia Quantitative Selection. Its strategy is to select the stocks with the largest holdings of excellent fund products in the market, estimate their holdings and construct a portfolio to form a "Public Fund Amount of Holdings Index Enhancement".

There are many public offering products similar to "copying homework", such as Xiao Mi's Harvest Research Alpha, Zingdao's Central European Quantitative Drive, and Yang Meng's Bodao Yuanhang. However, this type of strategy has not had good luck in the past two years, and the weak public offering heavyweights Take them down together.

As of this year, ** public offering quantification has various characteristics. Some talk about historical background, some talk about replacement of popular products, some talk about hardware systems, and some talk about product innovation**. The quantification of public offerings, which originally could not tell the difference, has told a new story thanks to the efforts of the entire industry.

03 It’s time to cool down

After the birth of ChatGPT in the United States, there are two domestic industries that are the most restless, one is the subjective public offering of trading AI, and the other is the public offering quantification of AI.

In fact, AI is indeed a good investment aid, and some quantitative researchers have confirmed to the author that AI has a great contribution to stock strategies. However, there are still many problems in the application of machine learning algorithms in public offerings and even the entire asset management industry.

Just like Tesla wants to achieve autonomous driving, it needs more mass-produced cars to collect road data. Improving the investment ability of AI can only feed enough historical data, but the historical data of the domestic capital market is relatively short. If you simply use the "information ratio of the past 5 years" and "return rate of the past 3 years", there will be overfitting risk.

**To a certain extent, a very important reason why the Renaissance of quantitative hedge funds can be so successful is that they have accurate data that can be traced back to the 1700s, to perceive the picture that others may not necessarily see. **

What's more difficult is that the signal-to-noise ratio of financial data is very low, and samples cannot be generated infinitely like voice images, so there are fewer samples available. What's more, there is no so-called truth in the entire financial market, and most scenarios where machine learning algorithms are applicable assume that the data has the same distribution pattern inside and outside the sample.

**So in order for the algorithm to adapt to the uncertain environment, in the short term, it may not rely on the machine's understanding, but more on human experience. **

Zhang Chenying of Egret Asset Management also talked about the difficulty of using AI, “When we use graph neural networks (GNN), we first need to use natural language processing to extract the upstream and downstream relationships between research reports, financial reports, and news stocks to build a knowledge graph. At the same time, GNN is very complex and requires a lot of manual experience to adjust many hyperparameters,** which requires users to have sufficient reserves in both data cognition and technical cognition. [1] **。」

Regardless of the complexity of the AI strategy itself, whether it is personnel reserves or computing power algorithms, there is a certain gap between public offerings and private placements in terms of AI.

From 2020 to the present, the entire fund industry has been like the ever-changing themes of A-shares-** value investment, boom investment, undervaluation, fixed income+, FOF, ETF, dividends, and now the quantification of public offerings. There are 1-2 hotspots every year. **

Public offering quantification still has its own limitations, and there are also challenges in leveraging AI, not to mention that not all revenue attribution comes from AI. Artificial intelligence is of course a hot label and a fresh story, but the fund industry has never lacked marketing momentum, but sustainable performance. Can this AI quantification really bring different vitality?

References