- Topic

34k Popularity

46k Popularity

11k Popularity

2k Popularity

2k Popularity

- Pin

- 🎉 Attention Alpha fans! Alpha’s latest TAG airdrop goes live today at 10 AM—first come, first served!

💰 Don’t forget to share your airdrop or points screenshot on Gate Square with the hashtag #ShowMyAlphaPoints# for a chance to win a share of the $200 token mystery box!

🥇 Top points winner: $100

✨ 5 outstanding posts: $20 each

📸 Pro tips:

Add a caption like “I earned ____ with Alpha. So worth it”

Share your points-earning tips or redemption experience for a better chance to win!

📅 Activity deadline: August 10, 18:00 UTC

Let’s go! See you tonight: https://www.gate.com/announcements/article - Hey fam—did you join yesterday’s [Show Your Alpha Points] event? Still not sure how to post your screenshot? No worries, here’s a super easy guide to help you win your share of the $200 mystery box prize!

📸 posting guide:

1️⃣ Open app and tap your [Avatar] on the homepage

2️⃣ Go to [Alpha Points] in the sidebar

3️⃣ You’ll see your latest points and airdrop status on this page!

👇 Step-by-step images attached—save it for later so you can post anytime!

🎁 Post your screenshot now with #ShowMyAlphaPoints# for a chance to win a share of $200 in prizes!

⚡ Airdrop reminder: Gate Alpha ES airdrop is - Gate Futures Trading Incentive Program is Live! Zero Barries to Share 50,000 ERA

Start trading and earn rewards — the more you trade, the more you earn!

New users enjoy a 20% bonus!

Join now:https://www.gate.com/campaigns/1692?pid=X&ch=NGhnNGTf

Event details: https://www.gate.com/announcements/article/46429 - Hey Square fam! How many Alpha points have you racked up lately?

Did you get your airdrop? We’ve also got extra perks for you on Gate Square!

🎁 Show off your Alpha points gains, and you’ll get a shot at a $200U Mystery Box reward!

🥇 1 user with the highest points screenshot → $100U Mystery Box

✨ Top 5 sharers with quality posts → $20U Mystery Box each

📍【How to Join】

1️⃣ Make a post with the hashtag #ShowMyAlphaPoints#

2️⃣ Share a screenshot of your Alpha points, plus a one-liner: “I earned ____ with Gate Alpha. So worth it!”

👉 Bonus: Share your tips for earning points, redemption experienc - 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

Things are heating up in Ethereum (ETH): Who will win the battle?

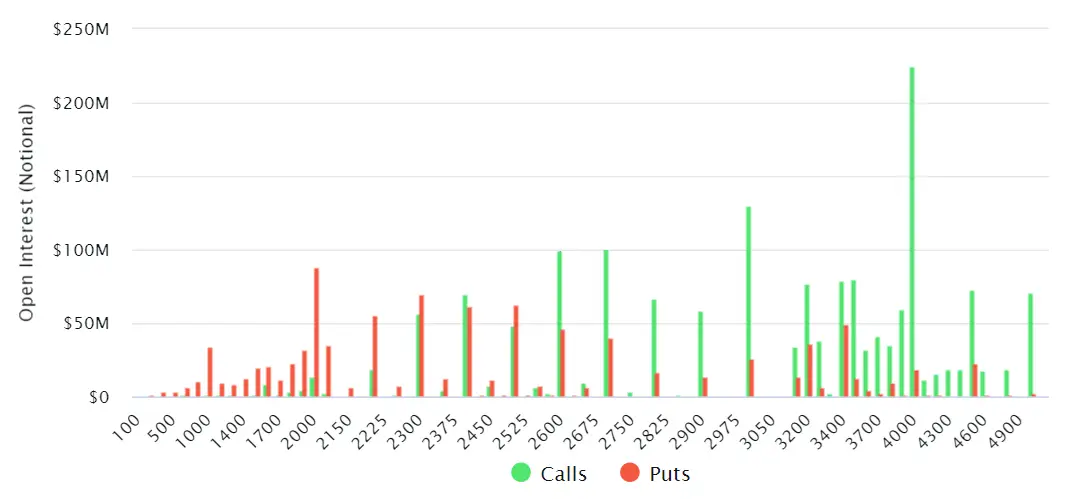

Ethereum (ETH) trading at a critical level is facing a $2.8 billion options threat.

ETH is trying to stay above the $2,600 resistance level after a 15.1% increase between September 18 and 23. The latest macroeconomic data showing a weakening economy has led to a rise in the stock market and increased demand for short-term government bonds. Along with this development, investors are focusing on the monthly Ether options worth $2.78 billion, which will expire on September 27, and this data, which is important for the altcoin market, seems to affect short-term trends.

What is the current situation in Ethereum (ETH) options?

Options that affect the price movement of the relevant cryptocurrency have become important for Ethereum. The leader of altcoins, which has been suppressed by Bitcoin for a while, has not been able to show the expected performance. However, various factors, including options, can reverse this situation.

There are four most likely scenarios based on Ether price trends. These predictions assume that the selling options represent bearish positions, while the call options are compatible with neutral-bullish strategies. However, it is important to note that this is a simplification and does not take into account more complex investment approaches.

This article does not contain investment advice or recommendation. Every investment and trading move involves risk and readers should conduct their own research when making a decision.