- Topic1/3

30k Popularity

20k Popularity

38k Popularity

8k Popularity

20k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

Bitcoin's rare signal: "It had risen by 10 thousand percent"

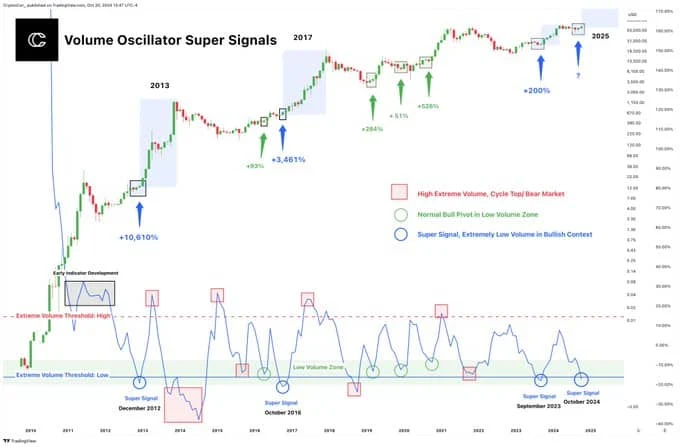

According to the analysis platform AMBCrypto, 'super signals' indicating a major increase in the Bitcoin (BTC) price chart have emerged.

A volume indicator used in the BTC chart has recently been giving consecutive 'super signals'. The analysis reported that this signal is a rare occurrence seen only in major rallies.

Historical data shows that such signals in BTC resulted in nearly 10,000% increase in 2012 and nearly 3,000% increase in 2016.

AMBCrypto claimed that if history repeats itself, BTC could experience a nearly 10% rise.

Bitcoin analysis signals a rally

Super signals, an indicator, were last seen in September 2023, when the price of BTC surged by 200 percent. The analysis indicated that another super signal emerged in October, called Uptober.

The analysis included the following statements;

"Super signals occur when trading volume is extremely low in a bullish market. Analysts suggest that these conditions point to accumulation as sellers decline while buying interest remains constant"

The leading cryptocurrency has experienced a 5.96% increase in the past seven days. The growing investor interest has had a positive impact on trading volume. According to CoinGlass data, the trading volume of BTC reached $42.62 billion. The rise in BTC's open interest in the options market to $25 billion has attracted attention.

Blockchain research platform IntoTheBlock stated that 71% of BTC holders have maintained their positions for over a year. 12% of BTC supply is in the hands of whales.

This article does not contain investment advice or recommendations. Every investment and trading activity involves risk, and readers should conduct their own research when making decisions.