- Topic1/3

30k Popularity

20k Popularity

38k Popularity

8k Popularity

20k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

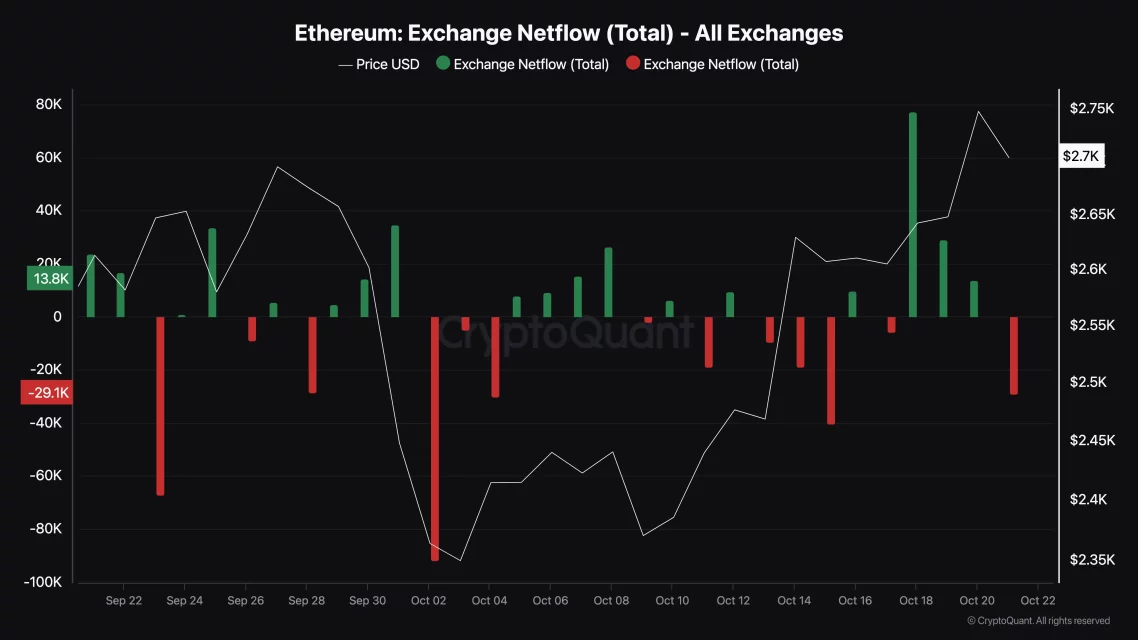

Is selling pressure decreasing in Ethereum?

Recently, approximately 30,000 ETH was withdrawn from cryptocurrency exchanges.

Ethereum (ETH) exceeded $2,700 for the first time since September 27th and shows strong signs of continuing its upward momentum. While there are no positive data from spot ETFs yet, onchain data indicates a rise for Ethereum. In addition, analysts believe that Ether will continue to move upwards.

Increase in the number of Ethereum holding addresses

Netflow data showing the amount of coins entering and exiting exchanges is positive for Ethereum. According to CryptoQuant, crypto investors withdrew 29,387 ETH from exchanges in a short period. High values in Netflow usually indicate increasing selling pressure. However, the withdrawal of approximately 80 million dollars worth of ETH from exchanges is expected to mitigate significant selling pressure in the short term.

Another criterion supporting the bullish outlook is the number of addresses holding 1 million dollars or more ETH. When this criterion increases, it indicates that investors are accumulating more coins and are in a bullish trend.

According to Glassnode's data, the number of addresses holding 1 million dollars or more worth of ETH has increased. This metric indicates the potential to avoid selling pressure on the Ethereum price.

Crypto expert reveals critical level for Ethereum

Crypto analyst and MN Consultancy founder Michaël van de Poppe also advocates a similar view. However, van de Poppe stated in his post that for ETH to reach $3,000, it needs to hold above $2,770. According to the analyst, once the $2,770 level is breached, the first target could be $3,200. The most critical area on the chart is the $3,900 - $4,100 range, which van de Poppe sees as the main resistance level.