- Topic1/3

55k Popularity

14k Popularity

45k Popularity

2k Popularity

987 Popularity

- Pin

- #Gate 2025 Semi-Year Community Gala# voting is in progress! 🔥

Gate Square TOP 40 Creator Leaderboard is out

🙌 Vote to support your favorite creators: www.gate.com/activities/community-vote

Earn Votes by completing daily [Square] tasks. 30 delivered Votes = 1 lucky draw chance!

🎁 Win prizes like iPhone 16 Pro Max, Golden Bull Sculpture, Futures Voucher, and hot tokens.

The more you support, the higher your chances!

Vote to support creators now and win big!

https://www.gate.com/announcements/article/45974

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

1️⃣ #ETH Hits 4800# | Market Analysis & Prediction: Boldly share your ETH predictions to showcase your insights! 10 lucky users will split a 0.1 ETH prize!

Details 👉 https://www.gate.com/post/status/12322612

2️⃣ #Creator Campaign Phase 2# |ZKWASM Topic: Share original content about ZKWASM or its trading activity on X or Gate Square to win a share of 4,000 ZKWASM!

Details 👉 https://www.gate.com/post/st - 📢 Gate Square #Creator Campaign Phase 2# is officially live!

Join the ZKWASM event series, share your insights, and win a share of 4,000 $ZKWASM!

As a pioneer in zk-based public chains, ZKWASM is now being prominently promoted on the Gate platform!

Three major campaigns are launching simultaneously: Launchpool subscription, CandyDrop airdrop, and Alpha exclusive trading — don’t miss out!

🎨 Campaign 1: Post on Gate Square and win content rewards

📅 Time: July 25, 22:00 – July 29, 22:00 (UTC+8)

📌 How to participate:

Post original content (at least 100 words) on Gate Square related to

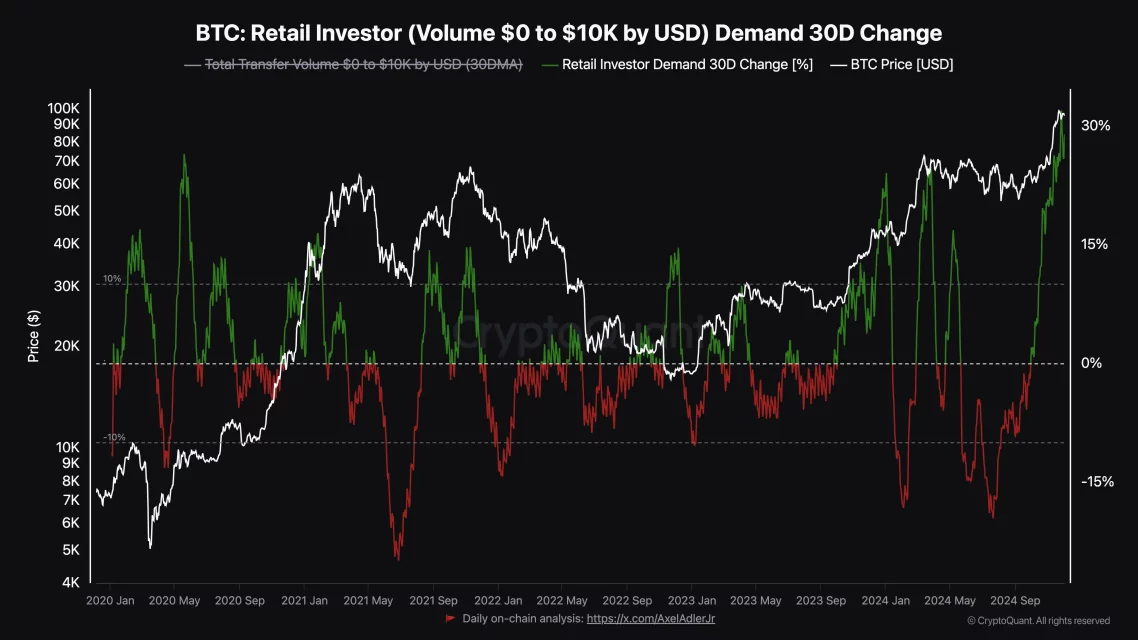

Demand for Bitcoin (BTC) is increasing: Bull run could accelerate!

Bitcoin (BTC) is facing a strong increase in demand with the re-entry of individual investors.

The current demand has even exceeded the levels seen in May 2020. Bitcoin's attempt to challenge the $100,000 level, which it has been unable to reach for a long time, is attracting attention. Especially the increase in BTC purchases by individual investors has raised expectations for the bull season. So what do onchain data show?

Analyst warning came

In the past, the price of Bitcoin used to rise after an increase in individual demand, a cycle often driven by whales and institutional investors. However, according to CryptoQuant data, this trend is changing. The 30-day metric of individual investor demand reveals the increasing influence of individual investors by tracking transaction volumes below $10,000.

The said metric reached the level of 27.15 at the moment, which is the highest level in the last four years. When this level was last approached, the price of Bitcoin rose from $9,500 to $37,000 within six months.

If history repeats itself, Bitcoin could surpass the $100,000 level within a few months. However, CryptoQuant analyst Darkfost is of the opinion that this level may not be surpassed quickly.

Can Bitcoin (BTC) reach $110,000?

On the weekly chart, Bitcoin has formed a bull flag pattern. This formation consists of a sharp price increase (pole) followed by a consolidation phase characterized by parallel trend lines (flag).

Bitcoin's exit from this formation indicates that the price could reach higher values in the short term. If this is confirmed, the price of Bitcoin could rise to $100,274 in a short period of time. Weekly closures above $100,000 could initiate a journey towards $110,000. On the other hand, if there is a decrease in individual investor demand, this prediction may not materialize, and the BTC price could fall to $90,275.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making decisions.