Liquidity funds come from Address frequently participating in trading and earning high profits (5950 BNB). In contrast, public funds that have not participated in trading have shown stable performance.

Author: M7 Research

Introduction

In our previous articles, M7 Research conducted an in-depth analysis of the $Libra scam, revealing market manipulation techniques through technical analysis and data insights. This time, we will focus on the $STAR10 token launched by Ronaldinho, providing market participants with transparent on-chain insights through analysis of its Liquidity distribution, opening trading dynamics, and fund flows.

Transfer: Transfer out 13M STAR10 to Address 0xd0bd630c747200f0766b2745e71f2f24f98bc366

The Address continues to add Liquidity and sells 49K STAR10 for 20 BNB

Remaining balance: 172M STAR10

Conclusion:

The funds in the Liquidity pool are frequently transferred and moved to the corresponding Address for trading. This behavior may involve the risk of circular fund utilization.

Has the public Address extracted Liquidity after opening?

Data Analysis:

Public Address: 0xb36ecbce305b309d9c15bf5ae9047cf1db1f790d

Liquidity added at the opening: recorded

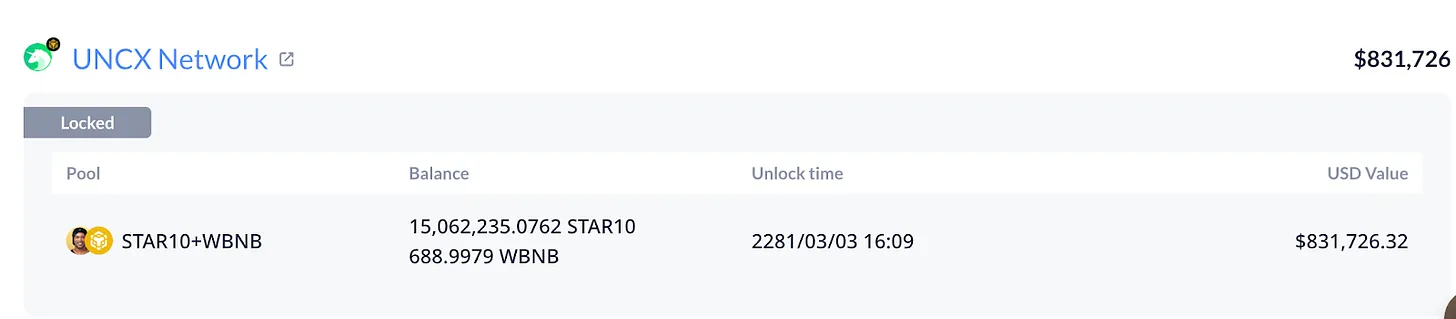

Current pool status: Still locked by UNCX, no Liquidity withdrawal

Liquidity reduction activity: recorded

Trading history link:

Conclusion:

The public fund pool has not been withdrawn, but there is a decrease in Liquidity. Further monitoring of fund flow is required.

Analysis of Capital Flow and Profit in the First Three Minutes of Trading

Data Analysis:

Dynamic in the first three minutes:

94.5% of the public pool tokens were shorted within the first three minutes, and the market Liquidity quickly dried up.

Main profit Address: 21个

Total Profit (PNL): 10,177 BNB

Associated Address Profit: 3,516 BNB

Top Address Profit Distribution:

Conclusion:

**In the first three minutes of trading, a large amount of profit is concentrated in a few Addresses. Among them, Address 0x01d9ecb735be61a89c4881eb0083c0adc225e14d obtained the highest profit (5950 BNB), and is associated with the source of Liquidity funds. This requires further scrutiny.

Did Liquidity and public funds Address participate in the transaction?

Liquidity source Address frequently participates in trading and has gained high profits (5950 BNB). In contrast, the public funding source has not participated in trading and has shown stable performance.

Summary

Through the on-chain analysis of $STAR10, we found:

Frequent operations on the Liquidity pool: There is a risk of circular fund utilization when LiquidityAddress is repeatedly added, removed, and funds are transferred.

The stability of the public fund pool: Although the public fund pool has not been withdrawn, further monitoring is needed to reduce Liquidity activities.

Profit concentration in the early trading period: A few Addresses make significant profits within the first three minutes, with suspicious connections to Liquidity sources.

High-frequency trading of Liquidity funding sources: Liquidity funding sources Address participated in active trading, realizing significant profits, while public funding sources remained static.

The content is for reference only, not a solicitation or offer. No investment, tax, or legal advice provided. See Disclaimer for more risks disclosure.

M7 Research: In-depth analysis of celebrity coin Little Luo (Ronaldinho) $STAR10 on-chain behavior

Author: M7 Research

Introduction

In our previous articles, M7 Research conducted an in-depth analysis of the $Libra scam, revealing market manipulation techniques through technical analysis and data insights. This time, we will focus on the $STAR10 token launched by Ronaldinho, providing market participants with transparent on-chain insights through analysis of its Liquidity distribution, opening trading dynamics, and fund flows.

$STAR10 Token Allocation Overview

How is 25% Liquidity utilized?

Data Analysis:

Conclusion:

The funds in the Liquidity pool are frequently transferred and moved to the corresponding Address for trading. This behavior may involve the risk of circular fund utilization.

Has the public Address extracted Liquidity after opening?

Data Analysis:

Conclusion:

The public fund pool has not been withdrawn, but there is a decrease in Liquidity. Further monitoring of fund flow is required.

Analysis of Capital Flow and Profit in the First Three Minutes of Trading

Data Analysis:

Dynamic in the first three minutes:

Top Address Profit Distribution:

Conclusion:

**In the first three minutes of trading, a large amount of profit is concentrated in a few Addresses. Among them, Address 0x01d9ecb735be61a89c4881eb0083c0adc225e14d obtained the highest profit (5950 BNB), and is associated with the source of Liquidity funds. This requires further scrutiny.

Did Liquidity and public funds Address participate in the transaction?

Data Analysis:

Trading Activity:

Trading Behavior: No records

Conclusion:

Liquidity source Address frequently participates in trading and has gained high profits (5950 BNB). In contrast, the public funding source has not participated in trading and has shown stable performance.

Summary

Through the on-chain analysis of $STAR10, we found: