Stablecoins Ranking 2025: USDT, USDC and Emerging Tokens Compared

Why Reference Stablecoin Rankings?

Within the Web3 space, stablecoins serve as essential tools for DeFi, trading, cross-border payments, and capital preservation. Keeping track of stablecoin market cap rankings and their characteristics not only helps users make informed choices, but also provides insights into which coins demonstrate stronger market confidence and longer-term viability.

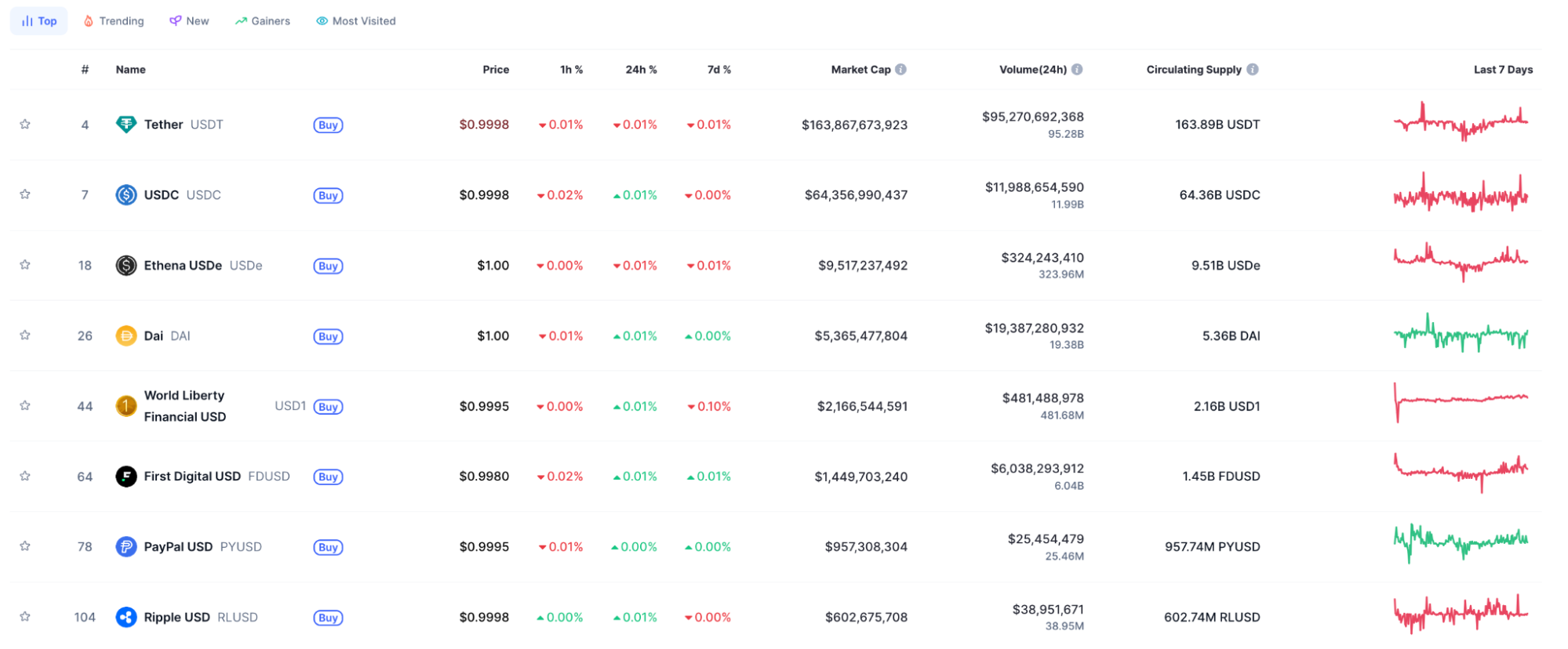

Stablecoin Rankings in 2025

Based on the latest market cap data as of the editorial cutoff, here is an overview of the top stablecoins, along with analysis:

- USDT (Tether)

Tether holds the top spot in the stablecoin market, with a market cap of about $160 billion and representing over 60% of the total stablecoin market. USDT is widely used in trading pairs and cross-chain asset transfers, offering high liquidity and global acceptance. However, questions around the transparency of its reserves occasionally arise. - USDC (USD Coin)

USDC has a market cap of approximately $64.3 billion. As a leading U.S.-issued and highly compliant stablecoin, its reserves primarily consist of cash and short-term U.S. Treasuries. Regular, independent audit reports provide a high level of transparency. - USDe (Ethena USDe)

Developed by Ethena, USDe ranks as the third-largest stablecoin with a market cap near $9.5 billion. As a newcomer featuring both collateralized and algorithmic stablecoin mechanisms, it has attracted interest from the market and developers. - DAI (MakerDAO)

DAI stands as the most prominent crypto-collateralized stablecoin, with a market cap close to $5.3 billion. It is primarily backed by ETH and governed by a decentralized community. While its risk management systems are mature, volatility in collateral values remains a key risk to manage. - USD1 (World Liberty Financial USD)

Issued by the U.S.-based World Liberty Financial, USD1 is an emerging fiat-backed stablecoin with a market cap of roughly $2.16 billion. It is backed by capital and branding, with reported business associations to the Trump family. - FDUSD (First Digital USD)

FDUSD, issued by First Digital, is a fiat-backed stablecoin with a roughly $1.45 billion market cap. It is primarily traded in Asian markets and is tightly integrated with blockchain platforms. - PYUSD (PayPal USD)

PayPal launched PYUSD in 2023, and it has a market cap of about $960 million. As an entry into crypto from a major payment platform, PYUSD is supported by PayPal’s brand reputation and public trust. - RLUSD (Ripple USD)

Issued by Ripple, RLUSD has a market cap of around $600 million and is used for internal transfers and cross-border settlements on the Ripple network.

(Source: coinmarketcap)

The Importance of Stablecoin Rankings and Selection Strategies

Market Cap as a Signal of Trust

USDT and USDC consistently account for more than 70% of the stablecoin market, highlighting their high liquidity and deep trading volumes. These coins are the preferred stable assets for major market participants.

Regulatory Standing and Transparency Affect Adoption

USDC is issued by a fully regulated entity with highly transparent reserves. USDe, USD1, FDUSD, and similar coins are innovative, but their regulatory status remains to be proved over time.

Each Stablecoin Type Has Unique Strengths and Trade-Offs

- USDC and USDT are fiat-backed, providing price stability but relying on centralized management.

- DAI is crypto-collateralized, offering censorship resistance, but faces risks from collateral price fluctuations.

- USDe is a hybrid or algorithmic stablecoin that is still in the experimental phase.

Common Stablecoin Use Cases

- Market making and arbitrage on exchanges: for example, using USDT/USDC as the primary assets for trading pairs

- Cross-chain transfers: stablecoins serve as bridges for moving funds across different platforms

- DeFi lending and Liquidity Mining: DAI and USDC are frequently used as collateral in lending protocols and to generate yields

- Integration with institutions and payment platforms: platforms such as PayPal and World Liberty expand stablecoin adoption through their business networks

Future Outlook

As regulations, like the GENIUS Act, move forward, more banks and corporations may launch their own stablecoins and enter the competition. New entrants such as Ethena’s USDe, PayPal’s PYUSD, and Ripple’s RLUSD could rise in the rankings as they increase user adoption and earn regulatory approvals.

To learn more about Web3, click here to register: https://www.gate.com/

Summary

The stablecoin market is still a relatively new sector. However, it now commands capital flows exceeding those of many major banking systems. By tracking stablecoin rankings, investors can identify capital preferences while also assessing transparency, trust, and regulatory compliance. When choosing a stablecoin, it is critical to consider use case, oversight, security, and ecosystem reach, rather than relying solely on market cap or current popularity.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025