TRUMP Coin Outlook: From Viral Surge to Market Stabilization

Preface

The TRUMP token rapidly gained traction within the Solana ecosystem, driven by its high-profile connection to former U.S. President Donald Trump. From its initial viral spread on social media to promotional events, including exclusive Trump-themed dinners for major buyers, the token quickly became a market sensation. However, this hype was short-lived. The price plunged from its peak of around $49 to approximately $7. This prompted market speculation about potential pump-and-dump activity.

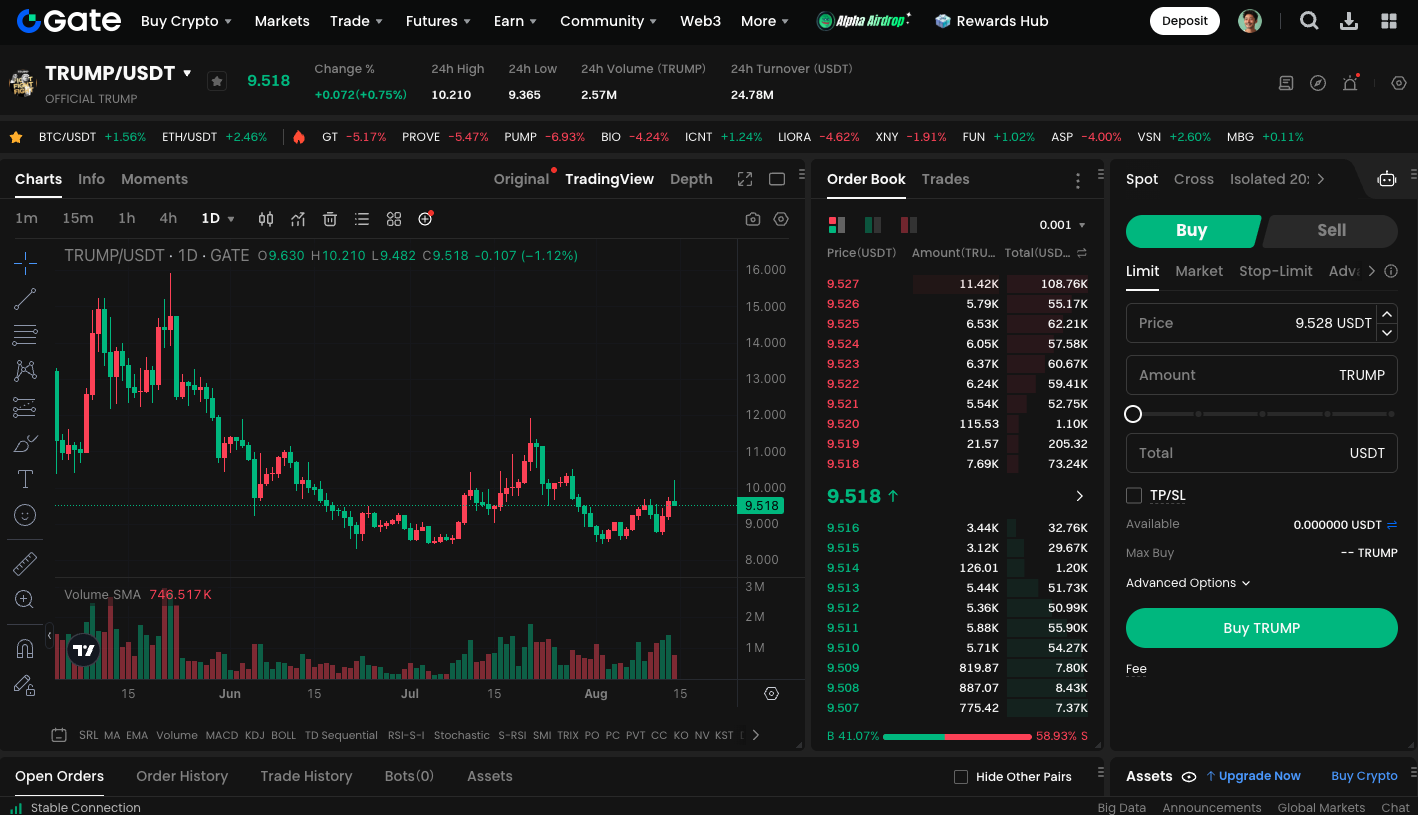

Current Market Overview

Although its early surge came to an abrupt halt, the TRUMP token showed resilience in the second quarter of 2025, consolidating within the $8 to $11 range for an extended period. At the time of writing, the price is around $9, with a market capitalization of about $1.78 billion and a circulating supply nearing 200 million tokens. Trading volumes remain robust, indicating that the token continues to attract significant market attention.

Price Trend Forecast

Currently, the TRUMP token is finding support between $8.5 and $9.5. A successful breakout above the $12 resistance could pave the way for a renewed push toward $16. Conversely, a break below support could result in the price revisiting the $7 low. In a bullish scenario, the third quarter may see a challenge of the $16 level, with a potential year-end high of $28.

2025 Price Range Projections

- Potential Low: $7

- Potential Average: $16 - $20

- Potential High: $28

Long-Term Outlook

If market sentiment remains positive, the TRUMP token may appreciate steadily over the next five years. By 2030, forecasts suggest its price could range between $70.75 and $212.25, with an average value around $141.50.

Market Evaluation and Analysis

Different institutions have offered varied outlooks on the TRUMP token’s price potential:

- Mudrex: Bullish target of $60 for 2025

- Icobench: Projects the price could reach $100 in 2025

- Binance: Takes a more conservative stance, forecasting a 2025 price near $13.93

Some analysts argue that continued investment in core use cases, community engagement, and marketing could position the TRUMP project to reach new highs in the next altseason.

TRUMP is available for spot market trading: https://www.gate.com/trade/TRUMP_USDT

Conclusion

Despite experiencing significant volatility, the TRUMP token continues to attract market attention, thanks to its celebrity branding and active community. Short-term price action depends on surpassing the $12 resistance, while long-term value relies on project fundamentals and sustained market support. Investors should conduct thorough risk assessments and remain informed about future developments.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025