In contemporary online culture, meme XXX is garnering widespread follow as a unique form of expression. This phenomenon is typically presented in the form of images, videos, or specific jokes, and spreads rapidly on online platforms. The characteristics of meme XXX lie in its highly infectious sense of humor, exaggeration, or biting satire, often triggering emotional resonance and imitation desire among users.

The origins of this cultural phenomenon may be diverse, including social hot topics, clips from popular films and television works, and even original content from ordinary netizens. With

The origins of this cultural phenomenon may be diverse, including social hot topics, clips from popular films and television works, and even original content from ordinary netizens. With

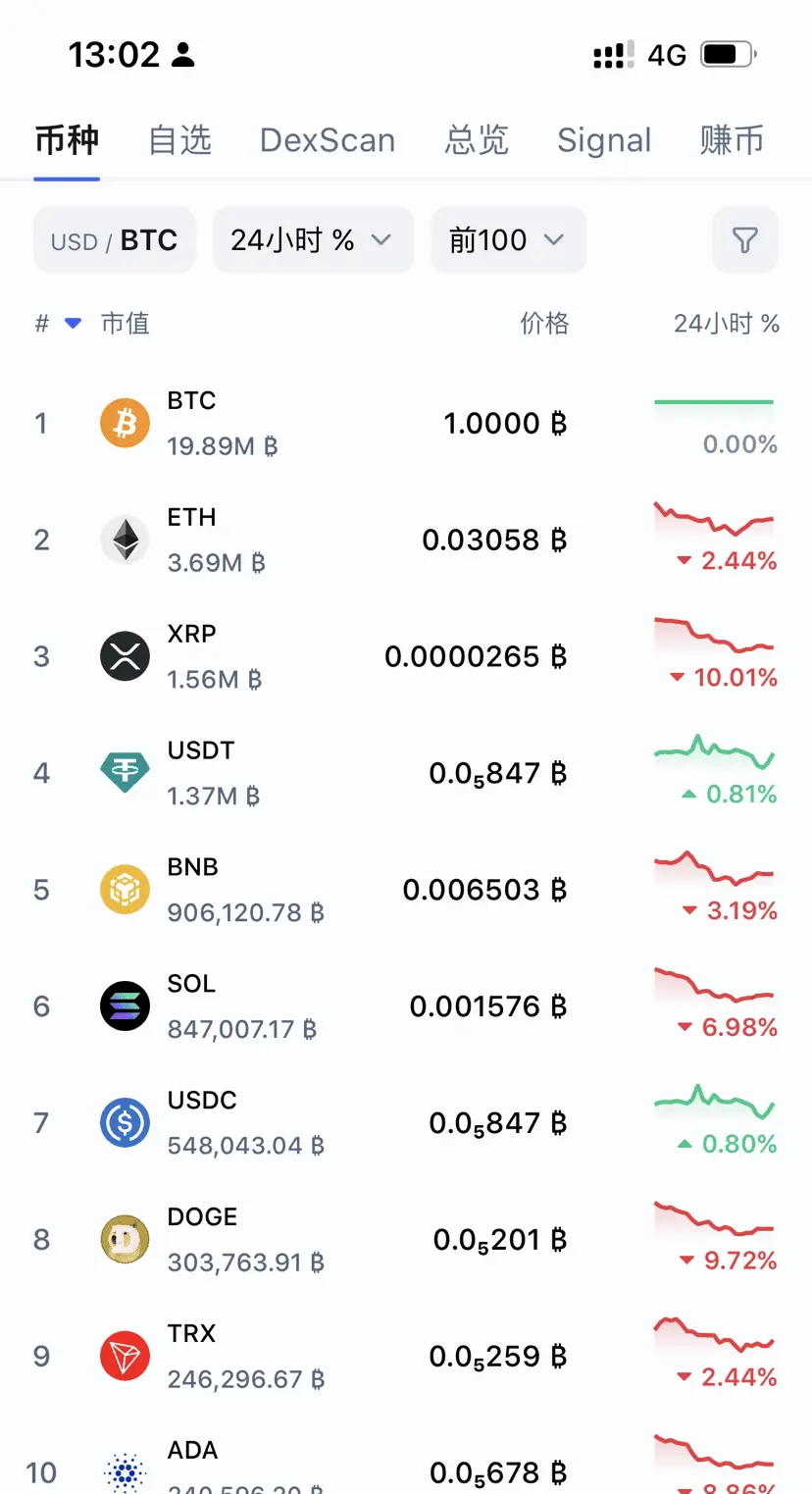

MEME-5.43%